Home » Posts tagged 'tax haven countries'

Tag Archives: tax haven countries

The 9 Best Tax Havens in the World

Generally, there is no standard definition that renders a country a tax haven. A tax haven is commonly a jurisdiction that offers low taxes, favorable taxes, no taxes, bank secrecy, and tax exemptions. The most important functions of a tax haven that attracts businesses from all over are: Provide secrecy of bank accounts from tax authorities of other countries and also provides a safe haven for ‘passive investments’. If you are an investor or you want to start a business here are the best tax havens countries that you should take advantage of…

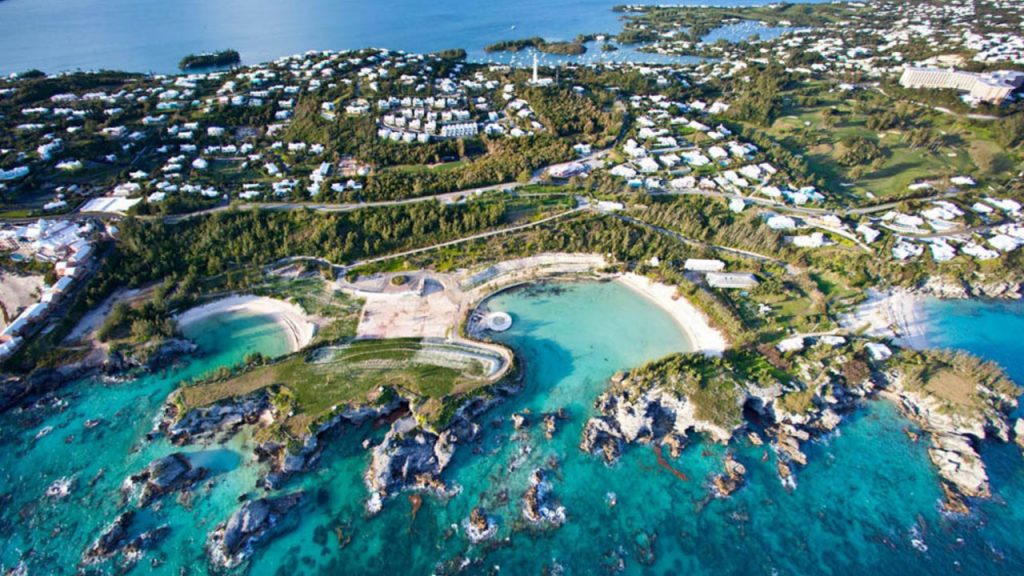

Bermuda

Was placed first on Oxfam’s list 2016 of the worst corporate tax havens worldwide. There’s no personal income tax rate as well as corporate tax charged and this has attracted many US companies who rip profits of up to $80 billion.

Luxembourg

From its business and tax-friendly laws, it has attracted hundreds of international countries to invest there and hence evade billions of taxes. According to Oxfam, it has zero percent withholding taxes, tax incentives, and large- scale profit shifting. It is one of the Benelux countries.

Netherlands

It is one of the Benelux countries and was placed third by the Oxfam list of the worst corporate tax havens. It has become the most famous among the Fortune 500.

Singapore

It has reasonable corporates taxes which it evades through lack of withholding taxes, tax incentives, and substantial profit shifting as reported by Oxfam.

Cayman Island

It has the largest tax evasion for both multinational corporations and individuals and was placed second on Oxfam lists of the worst tax havens. They allow a corporation to be established and retain its assets without necessarily paying taxes.

The Isle of Man

Located between Ireland and England it has the highest rates of 20% on low income-tax, has no turnover tax, capital gains or capital transfer tax. Most people have their employee pension plans here due to its great pension plans which favor employer-sponsored accounts only and not individual accounts.

Mauritius

Mauritius does not participate in international taxation and anti-abuse transparency initiatives have low corporate tax and no withholding tax. It is a famous country for investment with many mega corporations like Pepsi, Morgan Stanley, Goldman Sachs and Citigroup have subsidiaries there.