Plan Ahead for Long Term Care and Retirement

Living a long and healthy life is ideal for everyone, but unfortunately that is not always the case. According the to Retirement Research at Boston College, if you are over the age of 65 and are going into retirement in 2020 you are now expected to live another 19 years. People are indeed living longer than years before.

The older we get the more likely we are to face challenges that can be hard to overcome on our own. Age takes a toll not only physically on our bodies, but also our minds are not as quick as they used to be. By the year 2050 Alzheimer’s is predicted to increase to 14 million people. That’s a lot of people who need help with daily activities and assistance.

It is becoming more relevant and important to not only have Long Term Care insurance but to make sure that if you are around 40 years old that you start considering your future. Planning ahead for your retirement and health is highly important. Planning ahead can have many benefits but with the prices of Long Term Care Insurance it can be beneficial to get prepared now and make a game plan. Although you cannot predict the future you can do the next best thing and that is protect it.

Start looking and researching today what your options are for Long Term Care Insurance and start preparing for your future by planning ahead.

The 9 Best Tax Havens in the World

Generally, there is no standard definition that renders a country a tax haven. A tax haven is commonly a jurisdiction that offers low taxes, favorable taxes, no taxes, bank secrecy, and tax exemptions. The most important functions of a tax haven that attracts businesses from all over are: Provide secrecy of bank accounts from tax authorities of other countries and also provides a safe haven for ‘passive investments’. If you are an investor or you want to start a business here are the best tax havens countries that you should take advantage of…

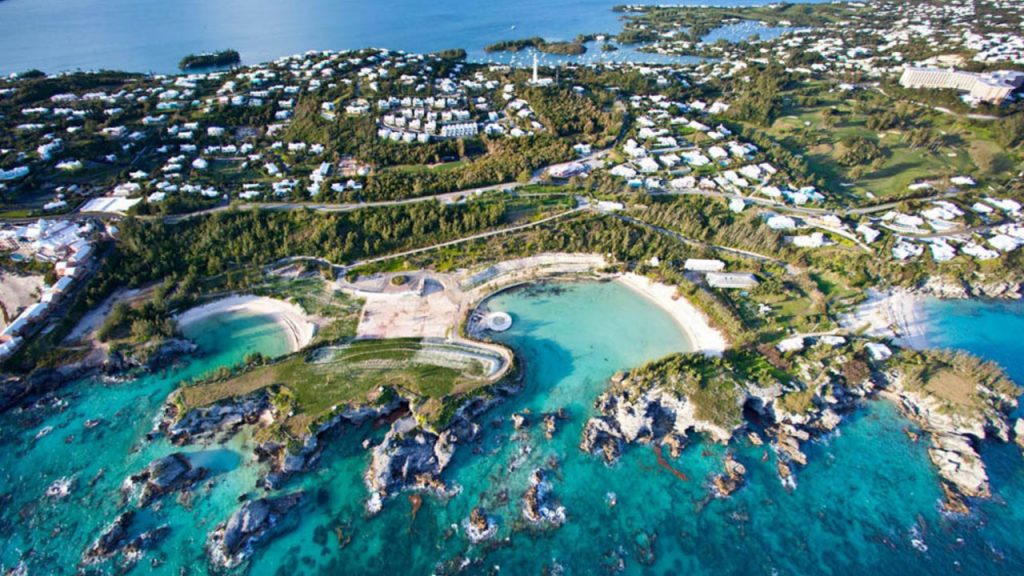

Bermuda

Was placed first on Oxfam’s list 2016 of the worst corporate tax havens worldwide. There’s no personal income tax rate as well as corporate tax charged and this has attracted many US companies who rip profits of up to $80 billion.

Luxembourg

From its business and tax-friendly laws, it has attracted hundreds of international countries to invest there and hence evade billions of taxes. According to Oxfam, it has zero percent withholding taxes, tax incentives, and large- scale profit shifting. It is one of the Benelux countries.

Netherlands

It is one of the Benelux countries and was placed third by the Oxfam list of the worst corporate tax havens. It has become the most famous among the Fortune 500.

Singapore

It has reasonable corporates taxes which it evades through lack of withholding taxes, tax incentives, and substantial profit shifting as reported by Oxfam.

Cayman Island

It has the largest tax evasion for both multinational corporations and individuals and was placed second on Oxfam lists of the worst tax havens. They allow a corporation to be established and retain its assets without necessarily paying taxes.

The Isle of Man

Located between Ireland and England it has the highest rates of 20% on low income-tax, has no turnover tax, capital gains or capital transfer tax. Most people have their employee pension plans here due to its great pension plans which favor employer-sponsored accounts only and not individual accounts.

Mauritius

Mauritius does not participate in international taxation and anti-abuse transparency initiatives have low corporate tax and no withholding tax. It is a famous country for investment with many mega corporations like Pepsi, Morgan Stanley, Goldman Sachs and Citigroup have subsidiaries there.

Tax Planning Tips for Small Businesses

Tax time to many small-scale businesses is usually the most difficult time of the year. Most people tend to ignore the tax planning process which is a very important stage that needs to be planned earlier. Instead of rushing and wasting your time when it’s too late, you can simply take advantage of the tips below for good tax planning.

Get organized – most people hate the tax period because they are not ready or organized. If you have a problem with being organized then you can choose a day in every month so that you can compile all your important documents like the credit card statements, bank statements, and invoices and this helps you keep track of your business expenses.

Give to charity – most consumers like above 90% support businesses that play a charitable role in the community. When it comes to charity, you need to choose a competent charity to make a donation for the simple fact that time volunteered is not taxed while any supplies you may sell during that time can be taxed. In case you donate cash make sure that you keep the receipts received from the charity well. You can also donate items like clothes, furniture, stocks and household goods and then claim a deduction for the fair market value.

Maximize your retirement plans – investing yourself is the best thing you are yet to do now. Deduct your retirement money from your income and this also reduces taxes. Here are some of the retirement plans that you should consider; Defined benefit plan, Simple IRA, Solo 401[k], Simplified Employee Pension [SEP IRA]. You need to consult a professional before opening any of these retirement plans.

Run an inventory check – depending on your accounting methods you can claim a deduction if the market value of your inventory drops. Check with your accountant to make sure that it applies to you.

Take section 179 Depreciation deduction – spend your money on making purchases of the items your business needs so that you can get maximum deductions. This deduction allows you in the same year that you bought the item to recover its full cost, it can be up to $500,000.

File your business taxes – make sure that you file all your business tax returns on time to avoid penalties. If you want to file your federal returns for free you can use Turbo Tax, you can also use Turbo Tax to file state tax at a fee and make sure that receive a confirmation.

Defer income – if you do not want your income to be counted for the current year then you can shift them to the next year using the help of your accountant and this can help you reduce your tax bill.

What Americans Want from Tax Reforms

Over 90% of all American citizens want investments tasked as much as wages. That’s according to a survey conducted by WalletHub. This debate has even been brought up through the current presidential election debates that are taking place in the country. Americans, it appears, want tax equality – and that means tax reforms.

Critics have argued that there’s worsening income equality under the last two administrations. This inequality has also been perceived through gender and marriage rights. Based on the WalletHub study that involved more than a thousand American taxpayers, below are the most common tax reform issues that people are interested in.

I. Equality before Economy

When asked what they thought was the most important among ‘tax fairness’, ‘tax equality’ and ‘what’s best for the economy’, most respondents in the survey placed economy at the end of their priority list. Over 60% said that they wanted tax fairness while about 20% placed a lot of prominence on tax equality. 18% thought that the economy was the priority issue. This perhaps wouldn’t have been the response a few years ago during the Great Recession, when a majority of Americans poured their hearts out to the economy.

II. More Simplicity with Fewer Deductions

Taxation is an expensive affair. In addition to the fact that about 31% of each American’s annual income goes to local, state and federal taxes, taxpayers spend billions (and a lot of time for that matter) trying to file returns and comply with tax regulations. That’s an additional cost that’s brought about by the complication of the tax code. Most Americans would wish that this code was less complicated. According to the WalletHub survey, more than 80% of the respondents think that the tax code has become ‘too complex’. This is compared to only 2% who think that it’s ‘simple’. Nearly half of polled respondents think that a simpler and fairer tax code would only have fewer deductions.

III.More Tax for Corporations

Wall Street vs Main Street – that’s a rivalry that has decorated the American taxation debate for years. Many taxpayers, it appears, were enraged by the government’s bailouts of major firms, including those that contributed to the recent recession. The fact that corporate profits have bounced much faster than household incomes typically ‘adds salt to the injury’. Some of the largest and most profitable American companies are parking overseas in order to avoid hefty taxation in the U.S. over 90% of respondents in the WalletHub survey said that investments should be tasked as much as wages are. This piece of information clearly highlights the current taxpayer sentiment.

IV. More Tax for Wealthy Americans

More Americans want a heavier tax burden imposed on the rich. In fact, most people would prefer a model where tax rates increased steadily based on income. This view has been held by American taxpayers for quite a long time, and it’s no surprise it’s brought up every time there’s a looming presidential election!

To sum it all up, American taxpayers really want Uncle Sam to view and treat all his children equally when it comes to paying taxes.

How the American Tax Code Favors the Rich

The American tax system favors the rich. Truly. According to massive economic experiments and studies on the impact of taxation, the general theory that guides tax-rate decisions is that ‘lower taxes attract more investment’, leading to more jobs and increased prosperity. As you file your next annual taxes, this article shows you exactly why the system is hijacked to favor the rich and super rich!

a) Poor Americans Do Pay Taxes

There’s been a lot of media myth speculating that poor Americans don’t pay taxes. For instance, Fox News host Gretchen Carlson once said that ‘47% of Americans don’t pay any taxes’. Based on a fact-check ¬¬¬¬though, this is wrong. Indeed, poor Americans pay lots of taxes! Data obtained from the Tax Foundation reveals that back in 2008, the bottom half of taxpayers had an average income of $15,300. This amount was below the tax exemption threshold of about $9,000 for singles and $18,000 for married couples. Effectively, that means that this group didn’t pay any INCOME taxes. But they still paid a lot of other taxes, including sales taxes, gas taxes, utility taxes, federal payroll taxes, etc. Apparently, no American is tax-free.

b) The Wealthiest Group Has a Lesser Burden

It’s true that the wealthiest 1% of wage earners pay about 40% of all federal income taxes. But people often forget that income tax is just a small fraction of the entire total taxation picture. The bottom 90% of wage earners are taking care of social security, unemployment insurance, and Medicare taxes. People who hit the $107,000 (roughly) tax mark are no longer required to pay more for social security. That means if you’re earning rounds off at this figure, you’ll be paying the same social security tax as Warren Buffet, Bill Gates, Mark Zuckerberg, and some other big-shot billionaires.

c) The Wealthier you are, the Lesser Taxes

The richest 400 Americans pay less in taxes, despite massive incomes. This is so thanks to a number of loopholes in the system, allowable deductions and other instruments of exemption. According to the Internal Revenue Service, the actual share of their income, that’s paid in taxes is just 16.6%. The majority of not-so-rich Americans have a federal tax burden that’s more than 20%.

d) A Good Proportion of the Richest Do Not Pay Any Taxes at All

Lots of the wealthiest people do live tax-free in America. Donald Trump’s tax records during his earlier career days suggest that he didn’t pay taxes for a couple of years. That’s because huge real-estate investors enjoy tax-free benefits following a 1993 law that was signed by President Clinton.

e) The Story is the same for Corporations

The biggest corporations have a lesser tax burden, as compared to small, upcoming firms. This appears to be an increasingly common trend depicting the national tax picture!

Although a recent study revealed American taxpayer sentiment about this system that appears to favor the rich, it’s always the same story. Lower taxes for big earners! It’ll be interesting to see how the tax debate unfolds during the 2016 presidential election campaigns.

6 Things Every American Should Know About Taxes

Every day is a tax day in America. Yes, a lot of confusion with tax forms, quick trips to the mailbox, and a lot of headaches associated with keeping up with taxation requirements. Every American citizen is subject to local, state and federal taxation. Nonetheless, there’s still a huge group of people who do not know anything solid about taxes. Here are 6 things every American citizen should be aware of when it comes to taxation.

1. Taxes are Expensive

According to research, taxes (at all levels), eat up about a quarter of the GDP (gross domestic product) every year. GDP refers to the entire total economic production value of a national annually. That’s about $4.8 trillion dollars. It’s no doubt not a trivial amount, and most informed taxpayers will understand this all too well. Based on information from the Tax Foundation, the average American citizen will work over three months each year to pay their share of taxes for the year. This means that up to 31% of all the money you make annually going to paying taxes. That’s a whole lot, you agree?

2. Different States, Different Taxes

A significant proportion of American taxpayers still do not know that different states have different local and state codes. Each state and its local authorities will structure a tax system that’s best in line with its needs. States such as New York, California and Wisconsin have greater tax burdens as compared to others. For instance, the taxation level in New York is nearly double that in Wyoming. Just so you know, it helps to do a little research to determine whether you’re paying more in your state that other Americans are paying in their states!

3. Government Doesn’t Collect Enough Money from Taxation

Although the American government and various local and federal authorities collect a significant proportion of the GDP in taxes, it’s just never enough. That means the federal spending is more than federal taxation. However, it’s important to note that in recent years, the federal spending levels have trickled down especially due to reforms in the budget. But the federal deficit is predicted to rise in the future decades, as a result of overspending. If you were perhaps wondering why the government owes China about $1.3 trillion, then you have your answer.

4. Taxes Affect the Performance of the Economy

There’s no doubt that taxes affect the performance of the economy. Based on studies from multiple sources, there are proven negative effects of taxation on investment and economic growth. For instance, people often think about the tax rate when considering where to relocate their family or business. That means locations with seemingly ‘unattractive’ tax rates could lose potential investment opportunities.

5. It’s Expensive to Comply with Taxation Requirements

Americans spend over $168 billion every year trying to file returns and comply with tax laws. And that’s before you even consider the money and time spent complying with local and federal taxes. The full cost of compliance for businesses and individual taxpayers is massive. Thus, tax compliance is a very expensive affair!

6. Where Does All the Money Go to?

Over half of all money collected from taxation goes to Medicare and social security. About 19% goes to income security and other benefits while national defense soaks about a whopping 17%. The remaining percentage is divided up amongst other areas such as education, transportation, etc.

This article emphasizes how taxes impact on your savings, work and investment. It also highlights just how much of your money goes out to various authorities at the local, state and federal levels. It’s a great starting point especially if you’re looking to bolster your tax education.

Will US-EU Trade Undermine Tax Justice?

This is a controversial question that has been brought up through a new study report. Based on information from the study, multinational companies in the U.K. could escape from paying millions of dollars following a secretive deal (labeled TTIP – Transatlantic Trade and Investment Partnership) between Europe and the United States that was brought up mid-February. The deal comes under the guise of free trade, but critics have warned that it would create a loophole through which major corporations would sue EU member states over measures such as windfall taxes on exceptional profits.

The deal is still an agreement that is currently being negotiated between the US and the EU. It has raised alarm bells especially amongst groups that advocate against unbridled free trade. While the stakeholders put forward the argument that it will bolster global trade, critics have stood their ground that the agreement may devastate both environmental and consumer protections while at the same time benefiting large international companies.

Published by the Transnational Institute in collaboration with Global Justice Now, the report warns that investor-protection embedded within its terms could put big companies beyond the reach of national taxation. Mr. Nick Dearden, a director at Global Justice, says that companies such as Google and Amazon are already paying minimal taxes in Europe and that this deal could even make this situation worse. Mr. Dearden has pointed out similar investor-protection in other deals that potentially prioritized corporate profitability over public welfare. A key example highlighted in the report was a dispute involving Mexico and several American agribusiness companies. This dispute reportedly happened in the early 2000s and centered on sales tax imposed on soft drinks containing high-fructose corn syrup by the Mexican government. The purpose of this tax was to reduce the increasing consumption of soft drinks. The tribunal tasked with addressing this dispute made a ruling that favored the investors. More so, Mexico was ordered to part with millions of dollars in damages.

5 Strategies to Improve Management of Reputational Risk in International Tax

The world’s is an increasingly global village, with interconnected financial systems and massive data sharing among various governments and jurisdictions. In recent times, new tax reporting requirements and the increasing need for tax information exchange between nations have led to the disclosure of key details on the tax affairs of multinational companies. Boards of Directors, CEOs, CFOs and other leaders in multinational organizations are aware of the increasing reputational risk related to international tax. According to an EY report, over half of all top executives from major corporations who were included in a study said that oversight of controversy and task risks had increased over the last two years.

Indeed, over 80% of tax executives who were interviewed said that they regularly briefed the company’s CEO and CFO on risks related to taxation. Nearly half of tax professionals in large companies also regularly briefed audit committees. This is an interesting piece of information especially at a time when firms are creating more structured approaches to managing their public tax profile. Below are some of the top strategies that companies are using to promote transparency readiness and manage reputational task risks.

- Monitoring the Changing Landscape – this involves actively studying and understanding the likelihood of increasing tax disclosure requirements. For instance, there might be an expansion of existing financial services reporting based on policy. Companies leverage their communications and PR departments to monitor interest in their tax profiles.

- Assessing Readiness to Respond to Risk Threats – more international firms are developing board-agreed strategies and plans of action regarding readiness This involves regular evaluations to determine that the tax function has a clear input into the business strategy and that it’s consistently in the scope of all major transactions.

- Enhancing Communication – establishing an effective communication strategy and approaches for reaching both internal and external stakeholders. At the internal level, the firm’s tax function should validate the approach to oversight functions such as risk officers, audit committees, public affairs, general counsels, and board of directors. The company’s leadership should be informed whenever there are any concerns related to taxation so that they can weigh them in among other risk factors.

- Creating Comprehensive Tax Reports – there’s a smooth flow when tax and accounting merge to help assess business motivations behind existing tax structures in each area where the firm operates. These reports should create a total tax picture that scopes how the firm contributes to the economy and much money it pays in taxes. These reports are a great way to trigger discussions on global risk management, audit functions, tax resolution processes, tax performance processes, etc.

- Embedding Reputational Tax Risks in Core Business Strategy – this is all about starting a dialog in order to allow the tax function to properly the reputational task risks related to ongoing business activities such acquisitions and mergers.

Proper tax management has always been an important part of doing business for large companies. Firms are looking to avoid tax scandals and lawsuits that have the likelihood to negatively impact their brand. The measures highlighted above are just a few of the many steps that international firms are taking to make sure that their tax affairs are in order!

Tax Deductions and Long Term Care Insurance

The Republicans have just scored a major victory in this last election and while it is hard to predict exactly how this will affect senior citizens, Howard Gleckman has some interesting thoughts in an article for Forbes Magazine. Typical of democrat scare tactics, Gleckman sees the Republican victory as a dangerous thing for government health programs. Meals on Wheels and a wide range of other community living programs have their budgets on the chopping blocks as the Republicans and even the Democrats look to save money.

The reality is we now have 18 Trillion in debt and of than almost 1/2 of that created under Obama in the past six years. Cuts need to be made and if a senior has a million bucks in the bank, they need to pay for their own long term care. Medicaid and government programs are designed for the truly needy, those who have below $10,000 in savings. Hard choices must be made if the debt is ever going to be tamed.

The Older Americans Act of 1965, which brought many of these services into being, has now been left by the wayside as government spending has exploded. The Great Society and War on Poverty was created nearly fifty years ago and we’ve spent over 50 trillion on trying to attack poverty and the out come has gotten worse!

Gleckman believes that the Republicans will even push for an increase in Medicaid premiums. Some Republicans even want to lump Medicaid in with Housing and Transportation, which many Democrats fear would make it easier for States to drop these services altogether in attempts to solve our physical crisis.

It is a rough time for seniors who do not have an insurance safety net to fall back on. The government seems poised to limit nursing home benefits just to the truly needly, not people trying to scam the system. The senior population is about to reach unheard of levels as the Baby Boom generation reaches their golden years.

These senior boomers will need to rely more and more on their own personal savings, and insurance as the government programs continue to erode. The space in the work force created by retiring boomers will undoubtedly lead to a smaller tax base. This will cause the government to find further spending cuts and reduced assistance for the elderly. The future is uncertain, we will just have to wait and see what the government is going to do with these programs. There is a good chance that many of them will survive until we reach old age. The question is, how effectively will they be running on their reduced budgets?

Buying private Long Term Care Insurance yourself is the best strategy as it will give you the control on where and when you receive care, not some government bureaucrat in Washington.. Especially when there are steps we can take right now to ensure that we are properly cared for in the future. Buying a Long Term Care policy will help Americans to avoid getting trapped in the red tape as they take charge of their own future by buying the insurance vs. depending on the government and being a burden to society. LTCTree is a site that we studied and found that will provide you with the tools you need to make your own decisions on Long Term Care insurance. We match you with policies that work for your life and your budget. There are no sales people at your kitchen table twisting your arm. We send you the information and let you make the decisions at your own pace. It is hard to know what the future will bring, but it is nice to know that you are covered.